Leverage the Halo Effect with AI to Win the Fight Against Fraud

Daisy Intelligence

Daisy Intelligence

The insurance industry has been undergoing a digital transformation for more than a decade. However, the COVID-19 pandemic has created a greater need for AI today, drastically accelerating the digitization of the industry over the last couple of years. For example, fraudsters are taking advantage of the economic uncertainty created by the pandemic, resulting in an increase of fraud across the board and making AI a must have to keep pace.

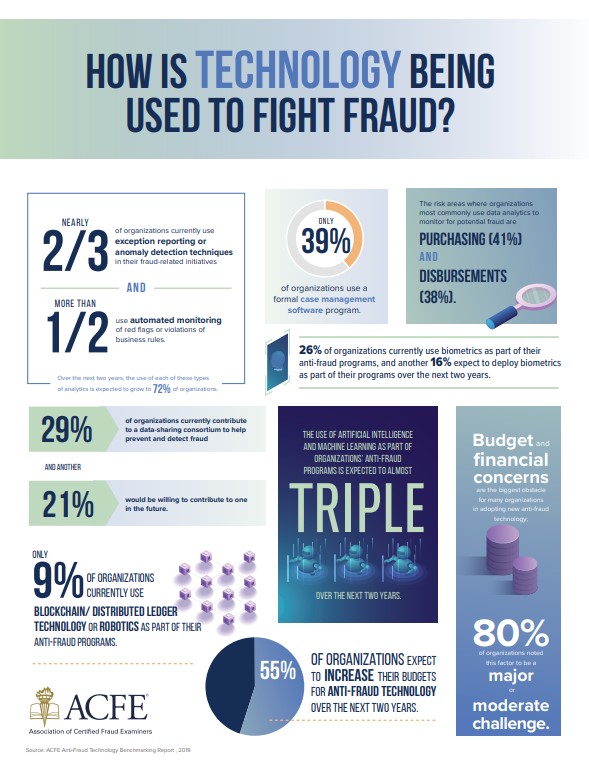

According to a study conducted by the ACFE, the use of AI and machine learning as part of organizations’ anti-fraud programs is expected to have tripled into 2021 and 55% of organizations expect to increase their budgets to make way for these anti-fraud technologies within the same time frame. Ultimately, insurers have recognized the growing imperative for AI technology, and those who have no plans to automate their core processes will not be able to effectively tackle fraud or compete on a price competitive basis with insurers who are applying AI.

Ultimately, leveraging the ‘Halo Effect’ with AI-based fuzzy logic (more on fuzzy logic below) provides insurers with a unique opportunity to detect previously unidentified fraud. The end result is proactively eliminating fraud and its effects across insurance organizations – securing long-term survival in the insurance space.

What is the Halo Effect and How Can it be Used to Fight Fraud?

In insurance, the Halo Effect is made up of outlying human behaviours – i.e., fraud and risk - that differ from similar people and similar claims. Fraud and risk are behaviours that are particularly difficult to identify as the notion of being different is an ambiguous concept. For example, a claim or person can have one attribute that is very different, or several attributes that are moderately different, etcetera. Furthermore, traditional, statistics-based outlier-detection methods fail when working with large volumes of ambiguous data. To avoid fraud and underwrite risk, the Halo must be identified by distinguishing it from all the groups of normal that occur in an insurance business. However, comparing every claim, and every person associated with every claim, is beyond human ability. Thus, to effectively fight fraud, insurers must apply AI-based fuzzy logic.

Fuzzy logic is a mathematical method of solving problems using qualitative data to produce quantitative outputs. Fuzzy logic represents ambiguous or “fuzzy” terms – i.e., “slightly,” “moderately,” etcetera – mathematically to produce quantitative outputs or decisions. In insurance, AI-based fuzzy logic systems autonomously choose the mathematical representations of fuzzy terms – i.e., the degrees of difference that exist in fraudulent claims - and then perform billions of comparisons to assign a score for the degree to which any claim or individual is in the Halo, or is an outlier, and is subsequently a flag for fraud.

AI Will Elevate, Not Replace, Insurers

AI undoubtedly eclipses human ability in the fight against fraud. However, this does not make the role of the insurer obsolete. AI serves the purpose of elevating people to do what they do best in the workplace. When AI takes on the task of uncovering fraud, a task it is far better suited to do, insurers and investigators are freed to take on more strategic roles, such as meeting genuine customer needs and focusing on profitability.

It cannot be overstated: AI is an imperative in the industry today. More than 50% of insurers already use automated monitoring of red flags, which is expected to grow to 72% by the end of 2021. Insurers who fail to automate their business processes will be greatly challenged to compete and tackle emerging fraud and risk in the shifting insurance landscape.

However, when leveraged in all aspects of risk management, identifying the Halo Effect with AI-based fuzzy logic will allow insurers to proactively avoid fraud, reducing its effects across insurance organizations and ensuring their continued survival.